Opportunity

Land-based RAS remains the only viable path to volume Salmon production in the US. Katahdin Salmon outcompetes any other US project or proposal on risk profile, time to market, and entry-level investment combined with “best in class” environmental stewardship in a scalable business model. We are the only company with 100% renewable energy.

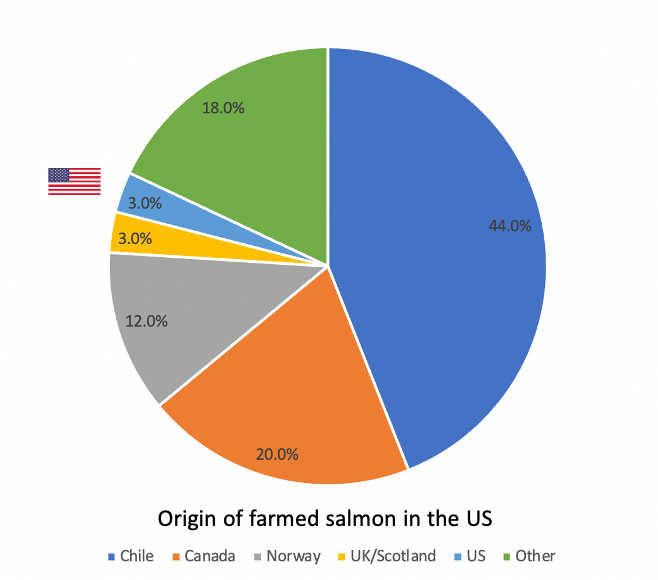

The US imports almost all of its Atlantic Salmon. There is an opportunity to close the import gap with increased domestic production.

Salmon is the most consumed finfish in the US and top two in market growth, yet the US imports over 90 percent of its salmon.

Food Security – Viable seafood supply solution US has 90% seafood deficit Delivery of local, healthy food Subject to US regulatory std

Katahdin salmon is targeting a sweet spot in terms of scale, risk, time-to-market, and large growth potential for quality salmon production in the US.

Experience and innovation will unlock expansion potential.

Local, sustainable salmon production in the US has strong selling points

A case for re-thinking salmon RAS grow-out in the US

Much of the attention in the RAS segment has been given to massive RAS projects in the past four years. 20,000-200,000 metric tons ambitions have received significant media attention. There are plenty of small projects, but salmon farming requires a certain scale to be competitive. The key is to find the critical scale to be both competitive in the market, while avoiding unnecessary high risk and complexity with very large scale.

We have done extensive site searches in the US with the conclusion that ideal sites for mega-projects are very hard to come by – we permitted two of the best places on each US coastline. Very Large RAS projects require significant infrastructure access, considerable water sources, and locations where one can attract and retain a large organization, in addition to balancing a range of environmental impacts. Designing, permitting, and operating such projects is complex and involves considerable risk. Many start-ups do not fully understand the full range of complexities. We believe scaling down is appropriate to generate the first generation of successful ventures in the US market. A successful operation can be scaled up down the road.

Risk related to RAS has been debated in the past years. The core technology has been operating for decades in the smolt industry – it works with robust designs. The core challenge is understanding the requirements and transition to grow-out operations. We can confidently say that ”proof of concept” has been established that RAS can produce high-quality salmon. But design and operations advancements are also needed for facilities to deliver on targeted biomass levels and thus revenue metrics. Knowledge has come far in the past 3-4 years, but the segment needs facilities and experience to capture this know-how in designs and operations. Experience, discipline, and quality focus in facility development are vital for successful execution. Some companies have cut corners and have paid a high price for that. Today, with a changing market several profiled US projects are so large that financing is challenging until financial ”proof of concept” is demonstrated. It isn’t straightforward for US investors to assess and pick out the best teams and projects. We are targeting a more viable scale and path, backed with extensive development experience.

Based on a decade of experience, our view is that the RAS sector can successfully grow in the US with well-planned, moderate-sized projects. Projects with a 4-5000 metric ton capacity and expansion potential up to 10,000 metric tons capture essential scale advantages. These are still large projects, so solid experience is needed to deliver financial results to investor expectations. The main reasons moderate size facilities can be strong winners are:

- Lower risk for the company, investors, and vendors.

- Lower entry investment level for investors.

- More viable site options are available for project development.

- Sufficient scale advantages can be achieved in moderate-size facilities.

- Local environmental impacts can be more easily mitigated.

- More manageable waste recycling volumes. Value enhancement on site.

- Move away from the seafood “mega factory” label to a local/regional food story.

- Less complex and faster permitting. Katahdin’s site requires mainly permit amendments.

The path to smarter growth

Ocean farming of salmon remains controversial in the US due to perceived escape, disease, and algae bloom risks. The only areas suitable are the northern coastlines of the eastern and western US. No one has successfully opened new salmon farms in the ocean in either region in a long time.

Katahdin Salmon balances the pros and cons of the alternatives to achieve a smarter path with fewer hurdles to growth. It has sufficient size to serve larger clients and to achieve scale advantages but significantly reduces local impacts, investor risk, and early capital requirements. Many more site locations are available at this scale for the future expansion of local food concepts.

Workforce Training opportunities

Katahdin Higher Education Center – East Millinocket (7 miles)

- Recent recipient of $4,000,000 to provide training and childcare

Eastern Maine Community College – Bangor (68 miles)

University of Maine – Orono (65 miles)

Maine Maritime Academy – Castine (111 miles)

- Millinocket has one of the largest alumni networks of marine/power engineers and logistics specialists in Maine.

Additional Training Resources available

Maine Quality Centers:

- Customized workforce training programs tailored to specific industry needs, through the Maine Community College System. E.g., Katahdin Higher Education Center, Eastern Maine Community College

Maine Department of Labor: On-the-job Training Funds

- 50% reimbursement of wages for up to 480 hours

- Apprentice support: $500 per worker accepted into program